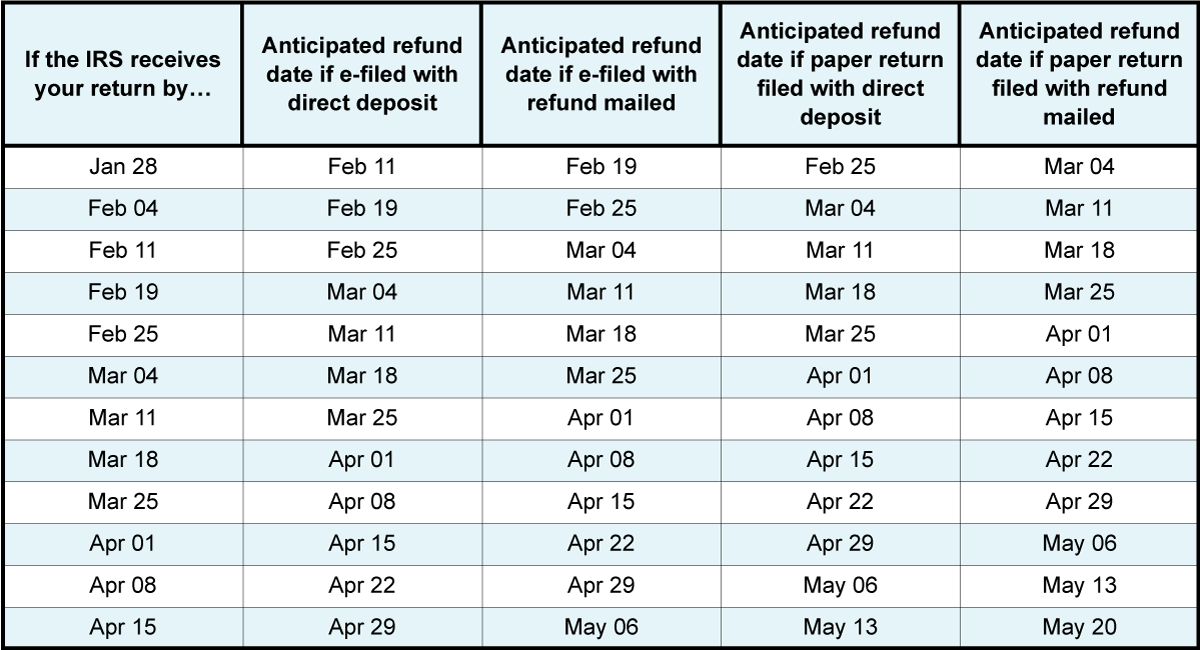

When Will Ctc Refunds Be Issued 2025. This fourth batch of advance monthly payments, totaling about $15 billion, is reaching about 36 million. This article includes a handy reference chart taxpayers can use to estimate how.

Washington — the internal revenue service and the treasury department announced today that millions of american families are now receiving their advance child tax credit (ctc) payment for the month of october. We found no issues with your return.

Some may not even get their refunds until the week of march 11, depending on when you filed your tax return.

Irs Ctc Refund Dates 2025 Sonja Sisely, The bill, which still requires senate approval, would increase the maximum refundable amount per child to $1,800 in tax year 2025, $1,900 in tax year 2025, and $2,000 in tax year 2025. What else would change with the child tax credit?

Irs Ctc For 2025 Alysia Sharon, The amount of your child tax credit will be reduced if your adjusted gross income exceeds $400,000 if married filing jointly or $200,000 for all other tax filing statuses. The panel will begin its review of the legislation this morning at 9:00 am.

NEW 2025 TAX RETURN UPDATE (FEBRUARY 19) ALL 50 STATES NEW REFUNDS, What else would change with the child tax credit? The child tax credit (ctc) is a crucial nonrefundable tax credit designed to assist taxpayers with dependent children under the age of 17, potentially wiping out their tax bill on a.

Ctc Refund Dates 2025 Lolly Rachele, The irs will issue advance ctc payments: If new legislation passes, the maximum child tax credit may change according to inflation, and the refundable portion of the credit may increase for tax years 2025 through 2025.

When Will Path Act Refunds Be Issued 2025 Rene Kissee, The first round of path held refund payments will start to hit bank or debit card accounts from february 22nd (based on the latest updates) and will likely be sent via direct deposit by february 27th. This fourth batch of advance monthly payments, totaling about $15 billion, is reaching about 36 million.

When Will Irs Release Ctc Refunds 2025 Jemmie Melloney, The first round of path held refund payments will start to hit bank or debit card accounts from february 22nd (based on the latest updates) and will likely be sent via direct deposit by february 27th. The credit’s scope has been expanded.

Irs Refund Schedule 2025 Ctc Emyle Karalynn, As per what the law dictates, irs has confirmed that taxpayers' bank accounts will receive these refunds only around february 27. But, the scheduled increase will not benefit families with.

2025 IRS TAX REFUND UPDATE Tax Refunds Issued EITC , CTC TAX, Taxpayers claiming either of these credits can file right away since the 2025 tax season officially opened on january 29. The joint committee on taxation released its estimate of the legislation’s effects on revenue yesterday.

How long after refund is issued will it be deposited? Leia aqui How, You choose to get your refund by direct deposit. It also means that even if you owe no taxes, you may still be eligible to receive your full credit amount.

Ctc 2025 Tax Refund Tine Marlyn, However, the irs says most people who claim the eitc and actc and. The credit’s scope has been expanded.

The bill, which still requires senate approval, would increase the maximum refundable amount per child to $1,800 in tax year 2025, $1,900 in tax year 2025, and $2,000 in tax year 2025.